Demand for disposable designs will fuel surgical instruments market

Aging populations and greater access to health care are spurring increases of 4 percent per year in ophthalmic surgeries worldwide through 2022, according to research firm Market Scope.

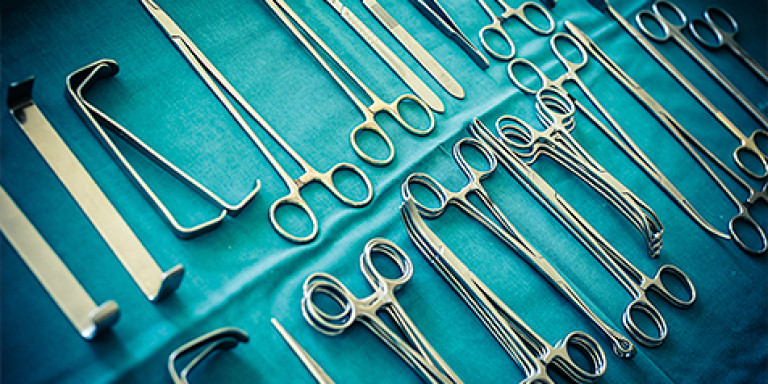

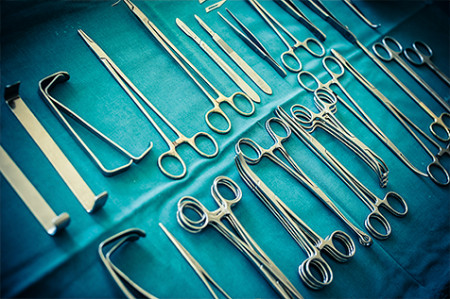

Market Scope’s recently published "2017 Ophthalmic Surgical Instruments Report" focuses on five categories of surgical instruments: reusable instruments, disposable instruments, reusable knives, disposable knives, and cautery devices. Increasing preference for disposable instruments and knives over the past decade has led to these devices accounting for nearly two-thirds of global market revenues. Ease of use, fear of cross-contamination, and cost of sterilization are factors that have enhanced the appeal of disposable instrument versions.

Global revenues for surgical instruments are expected to exceed $1.2 billion in 2017 and increase to nearly $1.6 billion by 2022 at a compounded annual growth rate of just over 5 percent, fueled by increases in the number of surgeries performed worldwide and rising demand for disposable instruments.

The growing trend toward ophthalmic microincision surgery is also significantly expanding market demand, especially in cataract and retinal surgeries, as surgeons use smaller-gauge instruments with increasing frequency. The trend is also expanding the popularity of disposable instrument versions because it is difficult to re-sterilize small-gauge reusable instruments without breaking them.

Market Scope expects reusable and disposable surgical instrument categories to benefit from worldwide growth in ophthalmic surgeries. Market Scope projects total global surgeries to grow from just over 41 million in 2017 to more than 50 million in 2022 at a CAGR of just over 4 percent.

Surgical instruments are used in all ophthalmic subspecialties, but cataract surgery is the most common procedure and offers the largest market opportunity, accounting for 63 percent of global ophthalmic surgeries and generating more than 56 percent of global revenues. Although representing only 4 percent of global ophthalmic surgeries, retinal surgery represents the second largest subspecialty segment, accounting for 22 percent of revenues in 2017. Fueled by an expanding variety of surgical instruments used in vitrectomy and a growing trend toward disposable versions, retinal surgery’s share of the global surgical instruments market will continue to increase through 2022. Together, cataract and retinal surgical instruments are expected to account for over 77 percent of global revenues in 2022.

The US is the world’s largest market for ophthalmic instruments, generating nearly a third of global revenues. The dominance of disposable designs accounts for the US market’s relatively large size. By 2022, fueled by a strong preference for disposable instrument designs, the US market is expected to increase to over a half billion dollars.

Western Europe is the second largest market. Together, the US and Western Europe are expected to account for nearly 60 percent of the worldwide market. We look for robust growth in revenues in the emerging markets of China, India, and Latin America, which will experience near double-digit growth in revenues over the next five years, driven by their expanding economies, growing elderly populations, improving health care delivery, and increasing use of disposable instruments.

Source: Market Scope